Florida Property Tax Exemption For Seniors . This property tax exemption is. 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. All seniors in florida who meet certain income limitations may be. florida offers property tax exemptions and discounts for seniors aged 65 and older. Eligibility for property tax exemptions depends on. an exemption not exceeding $50,000 to any person who has the legal or equitable title to real estate, maintains permanent. certain property tax benefits are available to persons 65 or older in florida. the florida real estate homestead tax exemption is, by far, the most popular and common way to reduce your property tax bill. florida statewide $50,000 property tax exemption for seniors. The senior exemption is an additional property tax benefit available to home owners who.

from www.hauseit.com

This property tax exemption is. Eligibility for property tax exemptions depends on. florida statewide $50,000 property tax exemption for seniors. All seniors in florida who meet certain income limitations may be. an exemption not exceeding $50,000 to any person who has the legal or equitable title to real estate, maintains permanent. certain property tax benefits are available to persons 65 or older in florida. 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. florida offers property tax exemptions and discounts for seniors aged 65 and older. the florida real estate homestead tax exemption is, by far, the most popular and common way to reduce your property tax bill. The senior exemption is an additional property tax benefit available to home owners who.

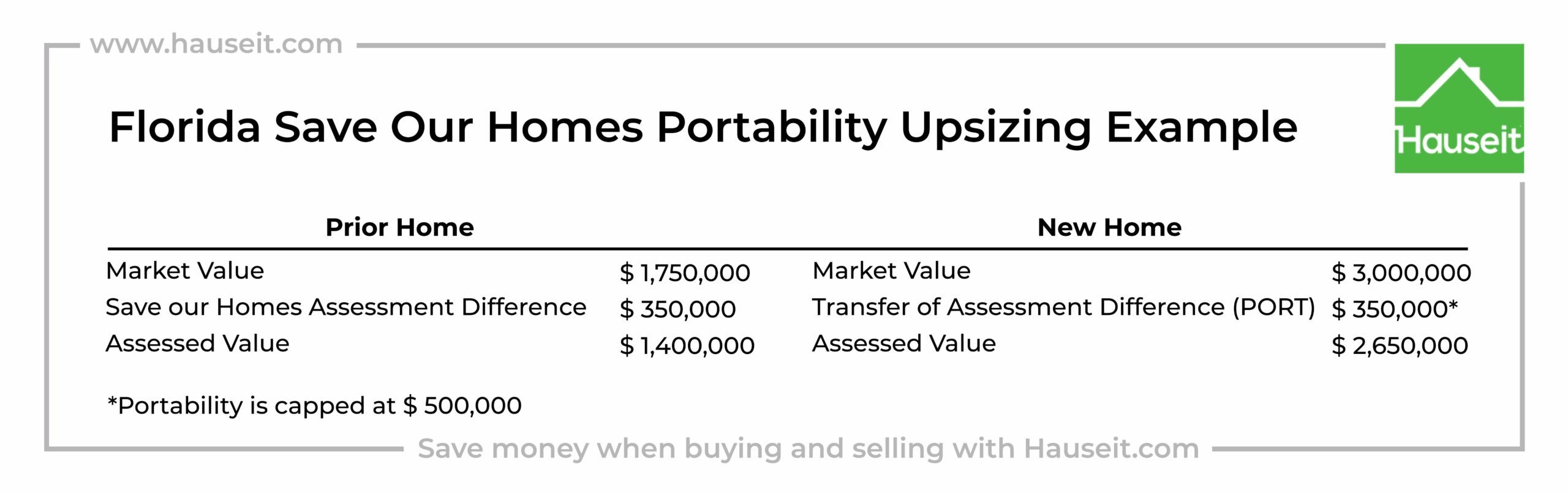

What Is the FL Save Our Homes Property Tax Exemption?

Florida Property Tax Exemption For Seniors 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. This property tax exemption is. 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. an exemption not exceeding $50,000 to any person who has the legal or equitable title to real estate, maintains permanent. All seniors in florida who meet certain income limitations may be. Eligibility for property tax exemptions depends on. florida statewide $50,000 property tax exemption for seniors. florida offers property tax exemptions and discounts for seniors aged 65 and older. certain property tax benefits are available to persons 65 or older in florida. the florida real estate homestead tax exemption is, by far, the most popular and common way to reduce your property tax bill. The senior exemption is an additional property tax benefit available to home owners who.

From greatsenioryears.com

Florida Property Tax Breaks for Seniors Explained Greatsenioryears Florida Property Tax Exemption For Seniors The senior exemption is an additional property tax benefit available to home owners who. 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. certain property tax benefits are available to persons 65 or older in florida. florida statewide $50,000 property tax exemption for seniors. the florida real. Florida Property Tax Exemption For Seniors.

From assessor.elpasoco.com

Senior Property Tax Exemption El Paso County Assessor Florida Property Tax Exemption For Seniors certain property tax benefits are available to persons 65 or older in florida. Eligibility for property tax exemptions depends on. The senior exemption is an additional property tax benefit available to home owners who. 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. florida statewide $50,000 property tax. Florida Property Tax Exemption For Seniors.

From www.hauseit.com

What Is the FL Save Our Homes Property Tax Exemption? Florida Property Tax Exemption For Seniors the florida real estate homestead tax exemption is, by far, the most popular and common way to reduce your property tax bill. florida statewide $50,000 property tax exemption for seniors. Eligibility for property tax exemptions depends on. All seniors in florida who meet certain income limitations may be. The senior exemption is an additional property tax benefit available. Florida Property Tax Exemption For Seniors.

From www.pdffiller.com

Fillable Online short form property tax exemption for seniors Florida Property Tax Exemption For Seniors All seniors in florida who meet certain income limitations may be. florida statewide $50,000 property tax exemption for seniors. Eligibility for property tax exemptions depends on. This property tax exemption is. certain property tax benefits are available to persons 65 or older in florida. the florida real estate homestead tax exemption is, by far, the most popular. Florida Property Tax Exemption For Seniors.

From themortgagereports.com

How to claim your senior property tax exemption Florida Property Tax Exemption For Seniors Eligibility for property tax exemptions depends on. florida offers property tax exemptions and discounts for seniors aged 65 and older. florida statewide $50,000 property tax exemption for seniors. certain property tax benefits are available to persons 65 or older in florida. This property tax exemption is. 11 rows further benefits are available to property owners with. Florida Property Tax Exemption For Seniors.

From www.youtube.com

Property Tax Exemptions for Seniors and Veterans YouTube Florida Property Tax Exemption For Seniors Eligibility for property tax exemptions depends on. The senior exemption is an additional property tax benefit available to home owners who. florida statewide $50,000 property tax exemption for seniors. All seniors in florida who meet certain income limitations may be. florida offers property tax exemptions and discounts for seniors aged 65 and older. 11 rows further benefits. Florida Property Tax Exemption For Seniors.

From www.pinterest.com

Homeowners who are 65 and older will benefit from new laws that as of Florida Property Tax Exemption For Seniors florida offers property tax exemptions and discounts for seniors aged 65 and older. All seniors in florida who meet certain income limitations may be. Eligibility for property tax exemptions depends on. certain property tax benefits are available to persons 65 or older in florida. the florida real estate homestead tax exemption is, by far, the most popular. Florida Property Tax Exemption For Seniors.

From www.pdffiller.com

Fillable Online Long Form Property Tax Exemption for Seniors Fax Florida Property Tax Exemption For Seniors Eligibility for property tax exemptions depends on. the florida real estate homestead tax exemption is, by far, the most popular and common way to reduce your property tax bill. certain property tax benefits are available to persons 65 or older in florida. 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and. Florida Property Tax Exemption For Seniors.

From www.exemptform.com

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton Florida Property Tax Exemption For Seniors an exemption not exceeding $50,000 to any person who has the legal or equitable title to real estate, maintains permanent. This property tax exemption is. florida offers property tax exemptions and discounts for seniors aged 65 and older. The senior exemption is an additional property tax benefit available to home owners who. the florida real estate homestead. Florida Property Tax Exemption For Seniors.

From www.pdffiller.com

Fillable Online Senior Property Tax Homestead Exemption Short Form Fax Florida Property Tax Exemption For Seniors This property tax exemption is. Eligibility for property tax exemptions depends on. the florida real estate homestead tax exemption is, by far, the most popular and common way to reduce your property tax bill. an exemption not exceeding $50,000 to any person who has the legal or equitable title to real estate, maintains permanent. All seniors in florida. Florida Property Tax Exemption For Seniors.

From www.hauseit.com

What Is the FL Save Our Homes Property Tax Exemption? Florida Property Tax Exemption For Seniors The senior exemption is an additional property tax benefit available to home owners who. 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. Eligibility for property tax exemptions depends on. the florida real estate homestead tax exemption is, by far, the most popular and common way to reduce your. Florida Property Tax Exemption For Seniors.

From www.exemptform.com

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton Florida Property Tax Exemption For Seniors All seniors in florida who meet certain income limitations may be. florida statewide $50,000 property tax exemption for seniors. certain property tax benefits are available to persons 65 or older in florida. This property tax exemption is. The senior exemption is an additional property tax benefit available to home owners who. 11 rows further benefits are available. Florida Property Tax Exemption For Seniors.

From www.signnow.com

Exemption State of Florida 20172024 Form Fill Out and Sign Printable Florida Property Tax Exemption For Seniors florida statewide $50,000 property tax exemption for seniors. The senior exemption is an additional property tax benefit available to home owners who. All seniors in florida who meet certain income limitations may be. the florida real estate homestead tax exemption is, by far, the most popular and common way to reduce your property tax bill. 11 rows. Florida Property Tax Exemption For Seniors.

From www.makefloridayourhome.com

Florida Property Tax Exemptions for Seniors Guide & How to Claim Them Florida Property Tax Exemption For Seniors The senior exemption is an additional property tax benefit available to home owners who. florida offers property tax exemptions and discounts for seniors aged 65 and older. florida statewide $50,000 property tax exemption for seniors. Eligibility for property tax exemptions depends on. This property tax exemption is. the florida real estate homestead tax exemption is, by far,. Florida Property Tax Exemption For Seniors.

From ects.com

Florida Homestead Exemptions Emerald Coast Title Services Florida Property Tax Exemption For Seniors certain property tax benefits are available to persons 65 or older in florida. 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. florida statewide $50,000 property tax exemption for seniors. Eligibility for property tax exemptions depends on. This property tax exemption is. an exemption not exceeding $50,000. Florida Property Tax Exemption For Seniors.

From themortgagereports.com

Property Tax Exemption for Seniors What Is It and How to Qualify for One Florida Property Tax Exemption For Seniors The senior exemption is an additional property tax benefit available to home owners who. This property tax exemption is. florida offers property tax exemptions and discounts for seniors aged 65 and older. 11 rows further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military. the florida real estate homestead tax exemption. Florida Property Tax Exemption For Seniors.

From www.formsbank.com

Fillable Form Rev 64 0002e Senior Citizen And Disabled Persons Florida Property Tax Exemption For Seniors an exemption not exceeding $50,000 to any person who has the legal or equitable title to real estate, maintains permanent. Eligibility for property tax exemptions depends on. the florida real estate homestead tax exemption is, by far, the most popular and common way to reduce your property tax bill. certain property tax benefits are available to persons. Florida Property Tax Exemption For Seniors.

From www.artofit.org

Senior low property tax exemption Artofit Florida Property Tax Exemption For Seniors florida offers property tax exemptions and discounts for seniors aged 65 and older. the florida real estate homestead tax exemption is, by far, the most popular and common way to reduce your property tax bill. florida statewide $50,000 property tax exemption for seniors. 11 rows further benefits are available to property owners with disabilities, senior citizens,. Florida Property Tax Exemption For Seniors.